Is your business ready for AFIR?

With the implementation of the Alternative Fuel Infrastructure Regulation in April 2024, a lot will change for charging point operators. An important one being payments.

Learn everything about AFIR in under 3 minutes by watching the video or read more on this page.

AFIR: How to set up a scalable and compliant payment infrastructure for charging networks

As of April, paying at charging points will be uniform and simplified.

AFIR stands for Alternative Fuel Infrastructure Regulation and is a new payments regulation that ensures paying at all charging points will be uniform and simplified. This means that drivers of electric vehicle will be able to pay with their debit or credit card at any charging station.

Under PSD2, owners of charging points will not be allowed to handle third party funds.

When AFIR is implemented, owners of charging points (or any other party in the supply chain) will not be allowed to handle third party funds and act as a payment service provider unless they have the required license to do so.

Charging point operators will need to work with a licensed payment provider.

Working with a licensed payment service provider will ensure you will stay compliant and are able tocsafely manage third party funds under the European PSD2 regulation.

How Online Payment Platform will ensure you stay compliant:

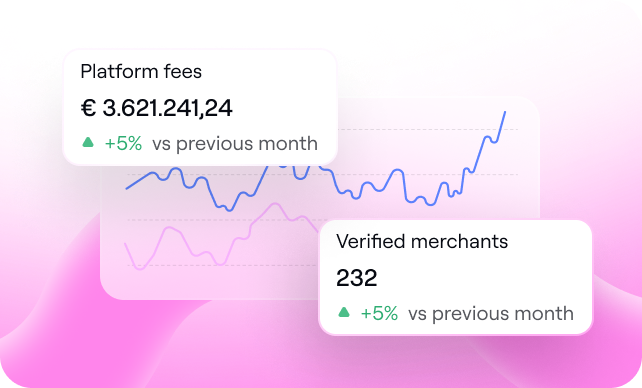

Compliance & Regulation

- Full compliance under PSD2 regulation through our license

- Management of Third Party Funds

- Licensed by DNB and relevant authorities

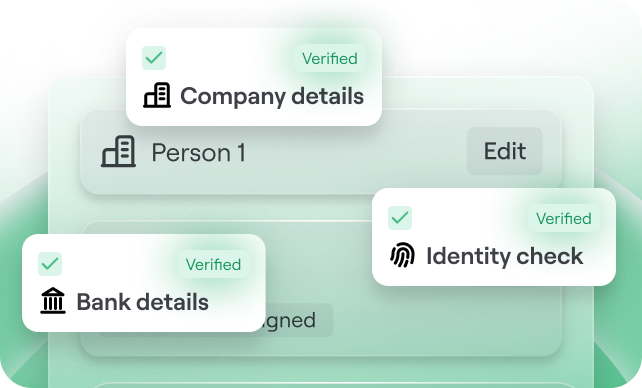

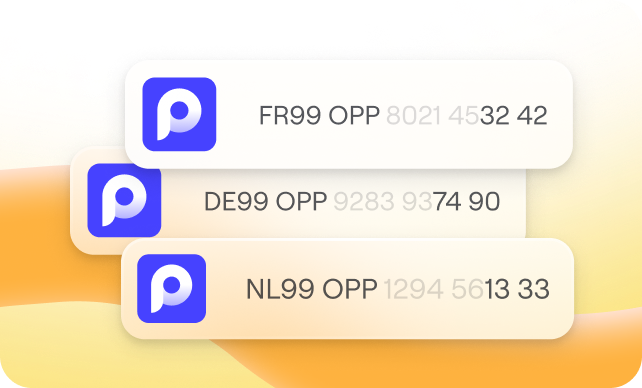

Onboarding of merchants

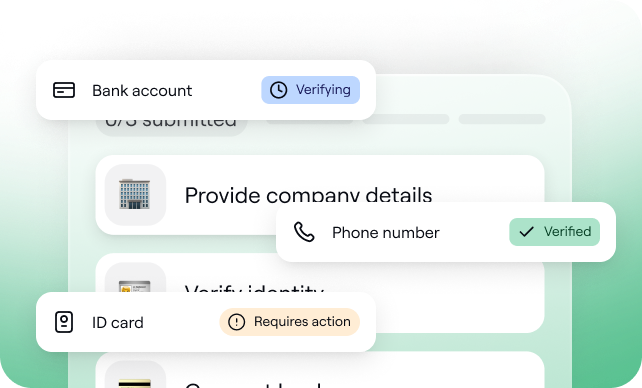

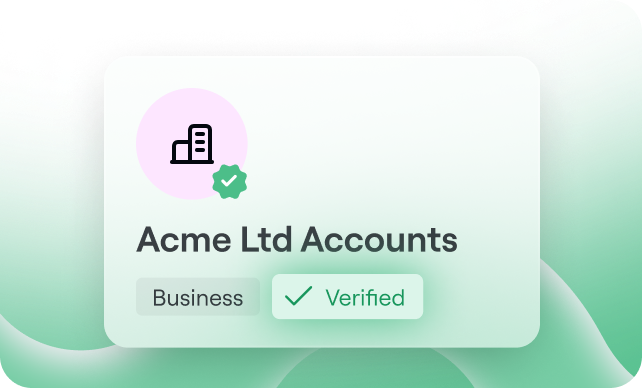

- Swift and diligent onboarding of merchants

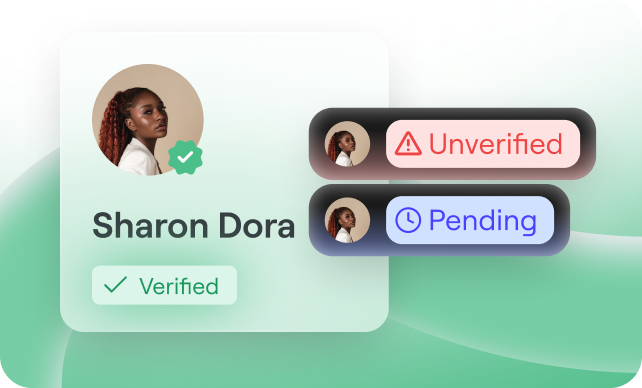

- KYC and KYB checks through OPP

- Advanced Fraud Detection tools and database

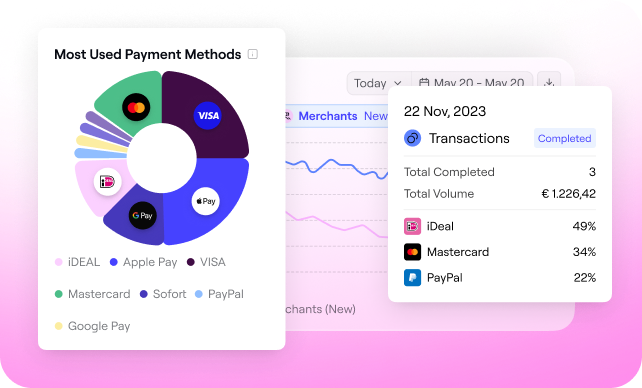

Specialized payment solution

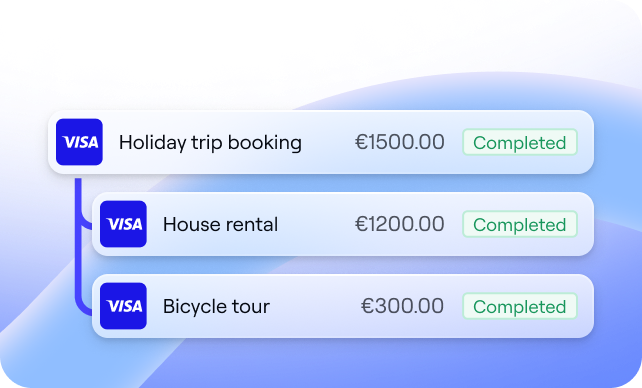

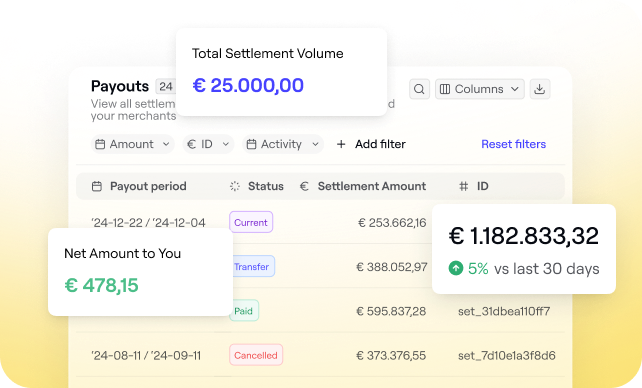

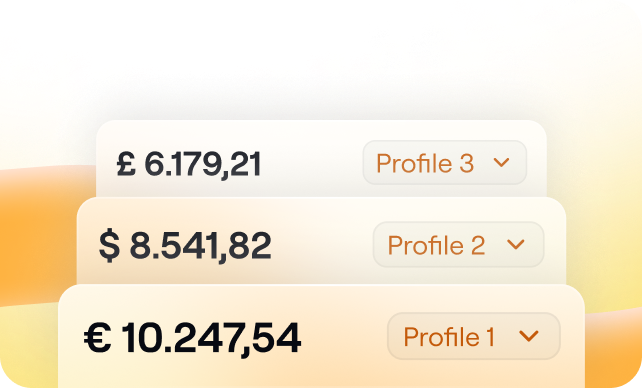

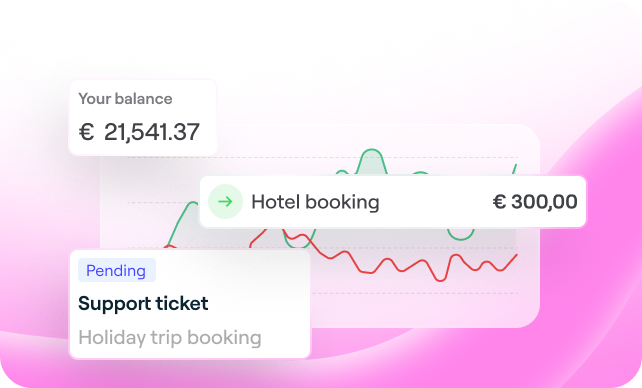

- Multi split payments to multiple beneficiaries

- Multi-currency support across European region

- Single API integration

We'll help you navigate AFIR

- Stay compliant under PSD2

- Ready to go payment solution

- Seamless merchant KYC

- 15+ years experience

.svg)

.svg)

.svg)

.svg)

.png)

.png?width=75&height=51&name=Worldline%20(2).png)